Latest Version

Version

5.38.17

5.38.17

Update

October 17, 2024

October 17, 2024

Developer

Easy Expense Tracker

Easy Expense Tracker

Categories

Business

Business

Platforms

Android

Android

Downloads

0

0

License

Free

Free

Package Name

com.easyexpense.mileage

com.easyexpense.mileage

Report

Report a Problem

Report a Problem

More About Automatic Mileage Tracker App

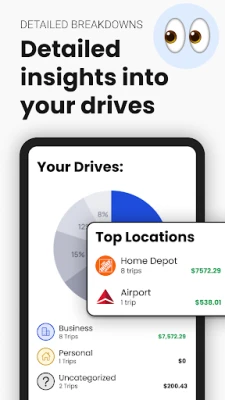

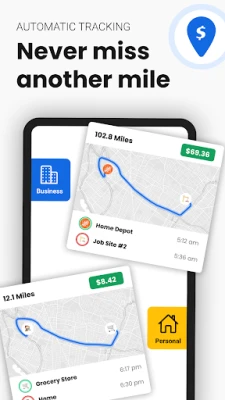

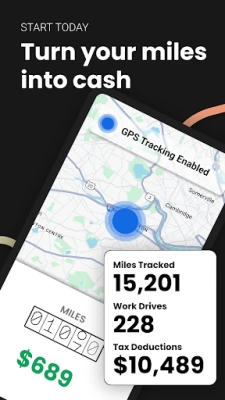

Looking for a reliable mileage tracking solution? 🚗 Easy Mileage is your go-to app for automatic mileage tracking and comprehensive expense logging, designed to maximize your tax deductions and streamline your business operations. Trusted by professionals across industries, Easy Mileage leverages your phone’s GPS to automatically track every mile you drive, ensuring precise and hassle-free mileage logs for tax reporting and reimbursements.

🚀 Effortlessly Track Your Miles and Expenses

With Easy Mileage, tracking your miles has never been simpler. The app runs seamlessly in the background, automatically detecting and logging your drives without the need for manual input. Whether you’re a freelancer, small business owner, or gig worker, Easy Mileage allows you to classify your trips with a swipe—right for business, left for personal—ensuring that every mile is accurately recorded and categorized.

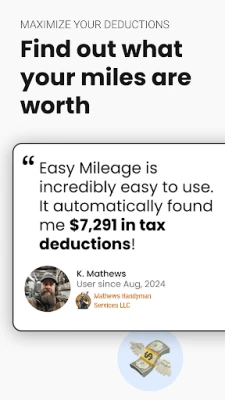

💰 Maximize Your Tax Deductions

Every mile you drive for work translates into significant tax savings. With Easy Mileage, you can easily track not only your miles but also your business expenses. Sync your bank accounts or credit cards to monitor all your work-related expenses, and never miss out on another deduction. In 2024, every 1,000 miles you drive could unlock substantial savings, and Easy Mileage helps you capture every eligible deduction.

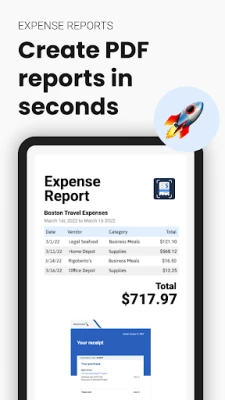

📊 Generate IRS-Compliant Reports with Ease

Whether it’s for taxes, reimbursements, or financial planning, Easy Mileage allows you to generate detailed, IRS-compliant reports with just a few clicks. Export your reports in PDF or Excel formats, or send them directly to your accountant. With customizable reporting features, you can track multiple vehicles, categorize trips, and ensure that your mileage logs meet all IRS requirements.

🎯 Tailored for On-the-Go Professionals

Designed with mobile professionals in mind, 🚗 Easy Mileage is perfect for anyone who drives for work—be it rideshare drivers, real estate agents, consultants, or sales associates. The app’s smart drive detection and automatic classification features make it easy to keep your business and personal miles separate, while its customizable settings allow you to pause tracking, set different reimbursement rates, and add notes to your trips.

✨ Join the Millions Who’ve Ditched Paper Logs

Stop leaving money on the table and join the millions of drivers who have embraced digital mileage tracking. With Easy Mileage, you can say goodbye to paper logs and manual tracking, saving time, money, and effort. Whether you’re managing a small team or just your own expenses, Easy Mileage is the ultimate tool to ensure you never miss a deduction.

🔑 Key Features:

- 🚗 Automatic Mileage Tracking: No need to manually log drives; Easy Mileage tracks your trips automatically.

- 💼 Seamless Expense Logging: Sync with your bank accounts to track all your business expenses.

- 🏷️ Simple Trip Classification: Swipe right for business, left for personal.

- 📋 Customizable Reporting: Generate IRS-compliant reports tailored to your needs.

- 👨💼 Designed for Professionals: Ideal for anyone who drives for work, from gig workers to small business owners.

- 🔒 Privacy and Security: Your data is secure and never sold.

🚙 Drive Smarter, Save More

Start maximizing your tax savings today with Easy Mileage. Whether for tax preparation, reimbursement, or financial planning, our app is your trusted partner for effortless mileage tracking and expense management. Try it for free and see how much you can save.

With Easy Mileage, tracking your miles has never been simpler. The app runs seamlessly in the background, automatically detecting and logging your drives without the need for manual input. Whether you’re a freelancer, small business owner, or gig worker, Easy Mileage allows you to classify your trips with a swipe—right for business, left for personal—ensuring that every mile is accurately recorded and categorized.

💰 Maximize Your Tax Deductions

Every mile you drive for work translates into significant tax savings. With Easy Mileage, you can easily track not only your miles but also your business expenses. Sync your bank accounts or credit cards to monitor all your work-related expenses, and never miss out on another deduction. In 2024, every 1,000 miles you drive could unlock substantial savings, and Easy Mileage helps you capture every eligible deduction.

📊 Generate IRS-Compliant Reports with Ease

Whether it’s for taxes, reimbursements, or financial planning, Easy Mileage allows you to generate detailed, IRS-compliant reports with just a few clicks. Export your reports in PDF or Excel formats, or send them directly to your accountant. With customizable reporting features, you can track multiple vehicles, categorize trips, and ensure that your mileage logs meet all IRS requirements.

🎯 Tailored for On-the-Go Professionals

Designed with mobile professionals in mind, 🚗 Easy Mileage is perfect for anyone who drives for work—be it rideshare drivers, real estate agents, consultants, or sales associates. The app’s smart drive detection and automatic classification features make it easy to keep your business and personal miles separate, while its customizable settings allow you to pause tracking, set different reimbursement rates, and add notes to your trips.

✨ Join the Millions Who’ve Ditched Paper Logs

Stop leaving money on the table and join the millions of drivers who have embraced digital mileage tracking. With Easy Mileage, you can say goodbye to paper logs and manual tracking, saving time, money, and effort. Whether you’re managing a small team or just your own expenses, Easy Mileage is the ultimate tool to ensure you never miss a deduction.

🔑 Key Features:

- 🚗 Automatic Mileage Tracking: No need to manually log drives; Easy Mileage tracks your trips automatically.

- 💼 Seamless Expense Logging: Sync with your bank accounts to track all your business expenses.

- 🏷️ Simple Trip Classification: Swipe right for business, left for personal.

- 📋 Customizable Reporting: Generate IRS-compliant reports tailored to your needs.

- 👨💼 Designed for Professionals: Ideal for anyone who drives for work, from gig workers to small business owners.

- 🔒 Privacy and Security: Your data is secure and never sold.

🚙 Drive Smarter, Save More

Start maximizing your tax savings today with Easy Mileage. Whether for tax preparation, reimbursement, or financial planning, our app is your trusted partner for effortless mileage tracking and expense management. Try it for free and see how much you can save.

Rate the App

Add Comment & Review

User Reviews

Based on 0 reviews

No reviews added yet.

Comments will not be approved to be posted if they are SPAM, abusive, off-topic, use profanity, contain a personal attack, or promote hate of any kind.

More »

Popular Apps

Submarine Car Diving SimulatorSwim with dolphins & penguins

Viking Clan: RagnarokKano Games

FastRay Fast VPN Proxy SecureFast VPN Proxy Vless & Vmess

Union VPN - Secure VPN ProxyPureBrowser

Govee LiteGovee

VPN Hotspot Shield Proxy 2023SwaharApps

Build World AdventureExplore city in cube world

Zoom - One Platform to Connectzoom.us

Oxy Proxy ManagerOxylabs.io

Craft of Survival - Gladiators101XP LIMITED

More »

Editor's Choice

Grim Soul: Dark Survival RPGBrickworks Games Ltd

Craft of Survival - Gladiators101XP LIMITED

Last Shelter: SurvivalLong Tech Network Limited

Dawn of Zombies: Survival GameRoyal Ark

Merge Survival : WastelandStickyHands Inc.

AoD Vikings: Valhalla GameRoboBot Studio

Viking Clan: RagnarokKano Games

Vikings: War of ClansPlarium LLC

Asphalt 9: LegendsGameloft SE

Modern Tanks: War Tank GamesXDEVS LTD