Latest Version

Version

4.6.3

4.6.3

Update

January 20, 2024

January 20, 2024

Developer

Intuit Inc

Intuit Inc

Categories

Business

Business

Platforms

Android

Android

Downloads

0

0

License

Free

Free

Package Name

com.intuit.qbmoney

com.intuit.qbmoney

Report

Report a Problem

Report a Problem

More About QuickBooks Money

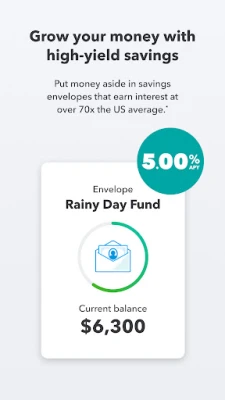

QuickBooks Money includes a business bank account with 5.00% APY,* payments, invoicing, and free same-day deposit (if eligible). Get started in minutes.

Business banking*

No monthly fees or minimum balance

Earn 5.00% APY on money saved in envelopes

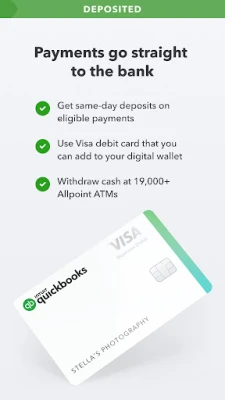

Get a QuickBooks Visa® Debit Card

FDIC insured up to $5 million

Move money, get paid faster

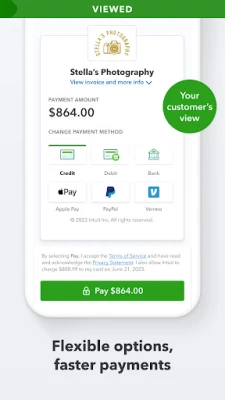

Give customers flexible ways to pay, like credit, debit, ACH, Venmo, PayPal, or Apple Pay®

Same-day deposits on eligible payments at no added cost*

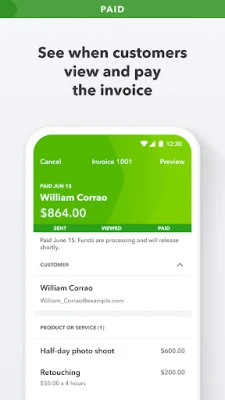

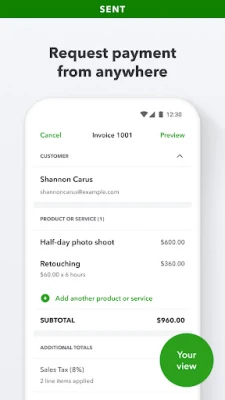

Save time on invoicing

Send instantly payable invoices

Add sales tax automatically*

Set recurring billing for repeat customers

Request payments with a link

Get a financial snapshot

See money come in and out

Make decisions that power growth

*Disclaimers

Intuit is a technology company, not a bank. Banking services provided by Green Dot Bank, Member FDIC

QuickBooks Money is a standalone Intuit offering that includes QuickBooks Payments and QuickBooks Checking. Intuit accounts are subject to eligibility criteria, credit, and application approval. Banking services provided by and QuickBooks Visa Debit Card are issued by Green Dot Bank, Member FDIC, pursuant to a license from Visa U.S.A. Inc. Visa is a registered trademark of Visa International Service Association. QuickBooks Checking Deposit Account Agreement (https://intuit.me/3nfroyc) applies. Banking services and debit card opening are subject to identity verification and approval by Green Dot Bank. Money movement services are provided by Intuit Payments Inc., licensed as a Money Transmitter by the New York State Department of Financial Services

Green Dot Bank also operates under the following registered trade names: Go2bank, GoBank and Bonneville Bank. All of these registered trade names are used by, and refer to, a single FDIC-insured bank, Green Dot Bank. Deposits under any of these trade names are deposits with Green Dot Bank and are aggregated for deposit insurance coverage up to the allowable limits. Additionally, with Green Dot Bank’s Deposit Sweep Program you are provided up to $5 million in FDIC insurance coverage on your account balances

Account balances above $250,000 will be automatically swept from Green Dot Bank and equally spread across our participating financial institutions, providing you with up to $5 million in FDIC insurance coverage. Customers are responsible for monitoring their total assets at each institution

Apple Pay is a registered trademark of Apple Inc.

Annual percentage yield (APY) is accurate as of December 13, 2023, and may change at our discretion at any time. The listed APY will be paid on the average daily available balances distributed across your created envelopes within your primary QuickBooks Checking account. Balances held outside envelopes will not earn interest. See Deposit Account Agreement for terms and conditions

Create up to 9 Envelopes. Money in Envelopes must be moved to the available balance in your primary account before it can be used

Average interest rate based on the Federal Deposit Insurance Corporation's national rate published the week of October 16, 2023. Learn more

Same-day deposit allows you to have near-real time deposits sent to you on a predetermined daily schedule (up to 3x/day, Mon-Sun, including holidays). Same-day deposit is an additional service by QuickBooks Payments subject to eligibility criteria, for no extra fee for QuickBooks Money users. Payment request fees apply for ACH and card transactions. Eligible deposits will be available in up to 30 minutes. For transactions after 9:00 PM PT, funds will be eligible for deposit the following morning. Deposit times may vary for third-party delays

Underlying sales tax rates estimated based on location information associated with each individual transaction

Other fees and limits apply to the business bank account

Terms, conditions, pricing, special features, and service and support options subject to change without notice

Some features not available on all platforms

No monthly fees or minimum balance

Earn 5.00% APY on money saved in envelopes

Get a QuickBooks Visa® Debit Card

FDIC insured up to $5 million

Move money, get paid faster

Give customers flexible ways to pay, like credit, debit, ACH, Venmo, PayPal, or Apple Pay®

Same-day deposits on eligible payments at no added cost*

Save time on invoicing

Send instantly payable invoices

Add sales tax automatically*

Set recurring billing for repeat customers

Request payments with a link

Get a financial snapshot

See money come in and out

Make decisions that power growth

*Disclaimers

Intuit is a technology company, not a bank. Banking services provided by Green Dot Bank, Member FDIC

QuickBooks Money is a standalone Intuit offering that includes QuickBooks Payments and QuickBooks Checking. Intuit accounts are subject to eligibility criteria, credit, and application approval. Banking services provided by and QuickBooks Visa Debit Card are issued by Green Dot Bank, Member FDIC, pursuant to a license from Visa U.S.A. Inc. Visa is a registered trademark of Visa International Service Association. QuickBooks Checking Deposit Account Agreement (https://intuit.me/3nfroyc) applies. Banking services and debit card opening are subject to identity verification and approval by Green Dot Bank. Money movement services are provided by Intuit Payments Inc., licensed as a Money Transmitter by the New York State Department of Financial Services

Green Dot Bank also operates under the following registered trade names: Go2bank, GoBank and Bonneville Bank. All of these registered trade names are used by, and refer to, a single FDIC-insured bank, Green Dot Bank. Deposits under any of these trade names are deposits with Green Dot Bank and are aggregated for deposit insurance coverage up to the allowable limits. Additionally, with Green Dot Bank’s Deposit Sweep Program you are provided up to $5 million in FDIC insurance coverage on your account balances

Account balances above $250,000 will be automatically swept from Green Dot Bank and equally spread across our participating financial institutions, providing you with up to $5 million in FDIC insurance coverage. Customers are responsible for monitoring their total assets at each institution

Apple Pay is a registered trademark of Apple Inc.

Annual percentage yield (APY) is accurate as of December 13, 2023, and may change at our discretion at any time. The listed APY will be paid on the average daily available balances distributed across your created envelopes within your primary QuickBooks Checking account. Balances held outside envelopes will not earn interest. See Deposit Account Agreement for terms and conditions

Create up to 9 Envelopes. Money in Envelopes must be moved to the available balance in your primary account before it can be used

Average interest rate based on the Federal Deposit Insurance Corporation's national rate published the week of October 16, 2023. Learn more

Same-day deposit allows you to have near-real time deposits sent to you on a predetermined daily schedule (up to 3x/day, Mon-Sun, including holidays). Same-day deposit is an additional service by QuickBooks Payments subject to eligibility criteria, for no extra fee for QuickBooks Money users. Payment request fees apply for ACH and card transactions. Eligible deposits will be available in up to 30 minutes. For transactions after 9:00 PM PT, funds will be eligible for deposit the following morning. Deposit times may vary for third-party delays

Underlying sales tax rates estimated based on location information associated with each individual transaction

Other fees and limits apply to the business bank account

Terms, conditions, pricing, special features, and service and support options subject to change without notice

Some features not available on all platforms

Rate the App

Add Comment & Review

User Reviews

Based on 0 reviews

No reviews added yet.

Comments will not be approved to be posted if they are SPAM, abusive, off-topic, use profanity, contain a personal attack, or promote hate of any kind.

More »

Popular Apps

Govee LiteGovee

Viking Clan: RagnarokKano Games

Submarine Car Diving SimulatorSwim with dolphins & penguins

World War Heroes — WW2 PvP FPSAzur Interactive Games Limited

FastRay Fast VPN Proxy SecureFast VPN Proxy Vless & Vmess

Union VPN - Secure VPN ProxyPureBrowser

Build World AdventureExplore city in cube world

VPN Hotspot Shield Proxy 2023SwaharApps

Zoom - One Platform to Connectzoom.us

Oxy Proxy ManagerOxylabs.io

More »

Editor's Choice

Grim Soul: Dark Survival RPGBrickworks Games Ltd

Craft of Survival - Gladiators101XP LIMITED

Last Shelter: SurvivalLong Tech Network Limited

Dawn of Zombies: Survival GameRoyal Ark

Merge Survival : WastelandStickyHands Inc.

AoD Vikings: Valhalla GameRoboBot Studio

Viking Clan: RagnarokKano Games

Vikings: War of ClansPlarium LLC

Asphalt 9: LegendsGameloft SE

Modern Tanks: War Tank GamesXDEVS LTD