Latest Version

Version

2.5.8

2.5.8

Update

October 12, 2024

October 12, 2024

Developer

1tap app

1tap app

Categories

Business

Business

Platforms

Android

Android

Downloads

0

0

License

Free

Free

Package Name

io.onetap.app.receipts.uk

io.onetap.app.receipts.uk

Report

Report a Problem

Report a Problem

More About 1tap receipts

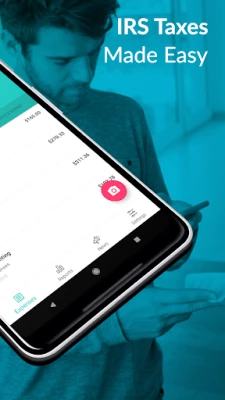

Self employed? Business expense tracking shouldn't be your main job! Accounting for your self employed business is quick and easy with 1tap receipts, the receipt scanner, receipt organizer and automatic IRS tax tracker app that lets you photograph any receipt, invoice or other business expense to automatically extract data for your IRS tax records & more.

💸 Self employed or contract workers – the tax deadline here! File your taxes by April 17, then get a head start on tracking this year’s expenses. File estimated taxes throughout the year and get the most out of your tax rebate by tracking every receipt and expense.

Receipts have a tendency to go missing when you need them. Business receipts can be kept in one place, organized & instantly categorized with 1tap.

1tap makes it easy to scan & track expenses for freelancers, contractors or self employed individuals. Bookkeeping, saving receipts and tracking expenses for your self employed business can be done in a fraction of the time.

Go paperless with 1tap and make your self employed IRS tax return tracking and receipt organization as easy as one quick snap. Tracking expenses for tax time is simple with auto-population and easy categorization.

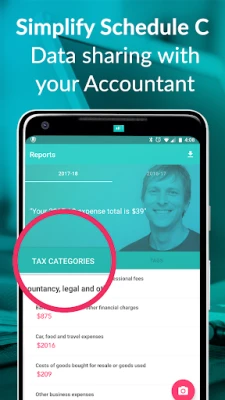

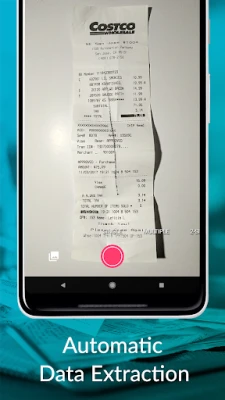

Scan receipts and invoices by snapping a photo. 1tap will extract data including supplier, date, amount and Schedule C tax category for you with UNBELIEVABLE accuracy. You can even see what purchases you can make with your tax savings!

💰Remember, the more receipts you claim back as a business expense, the less tax you pay, so snapping receipts boosts your income!

1TAP RECEIPTS FEATURES:

Receipt Scanner & Tracker App 🔍

- Scan receipts on the go

- Receipt scanner instantly finds and logs relevant data

- Scanner app with amazing reliability, even on crumpled business receipts!

- Scan one receipt or many at once

- Tracking expenses shouldn't take forever. Let 1tap receipts do the work!

Self Employment IRS Tax Calculator 📱

- Self employed? Contractor? Tax time doesn’t have to be painful. Just snap to start!

- Receipt scanner extracts key information for business expenses & IRS Schedule C categorization

- Schedule C categorization is easy & automatic!

- Tax management and calculation can be tricky. 1tap will take care of it!

Turn Expenses Into Cash 💰

- Tax returns are due now! See how much money you’ll get back from the IRS on your tax return instantly

- 1tap even suggests rewards you could buy with your refund

- Business expense organization and tax management are fast & simple with 1tap

Self Employed & Contract workers - from entertainers, construction, photographers, designers & more - 1tap is perfect for you!

Choose the 1tap Prime subscription that's right for you:

1tap Prime Lite

============

- 100 auto-scans per year

- 24/7 receipt processing

- Comprehensive CSV exports

- 20GB receipt storage

- 12-month subscription: $24.99

1tap Prime Pro

============

- Everything in 1tap Prime Lite

- Unlimited receipt scanning

- 50GB receipt storage

- 12-month subscription: $49.99

1tap Prime Max

============

- Everything in 1tap Prime Pro

- Real-time sharing with accountant

- Includes VAT

- 12-month subscription: $119.99

Self employed & contractors have serious responsibilities and shouldn’t have to spend hours mired in stressful accounting work. 1tap receipts offers a smart & easy alternative that makes tracking your IRS Schedule C, tax return and finances for tax time hassle-free.

HOW IT WORKS:

1. SNAP A PHOTO

Open 1tap receipts and snap your receipt or invoice.

2. EXTRACT EXPENSES

Data from your receipts and invoices is automatically extracted & placed in the correct Schedule C category for your IRS tax return.

3. SAVE AND SHARE RECEIPTS

Receipts and invoices are safely stored, so you can share them with your accountant, business partners, bookkeepers or whoever else may need to see them.

Check out the reviews or try it out right now with the worst receipt you can find and see how it goes!

Receipts have a tendency to go missing when you need them. Business receipts can be kept in one place, organized & instantly categorized with 1tap.

1tap makes it easy to scan & track expenses for freelancers, contractors or self employed individuals. Bookkeeping, saving receipts and tracking expenses for your self employed business can be done in a fraction of the time.

Go paperless with 1tap and make your self employed IRS tax return tracking and receipt organization as easy as one quick snap. Tracking expenses for tax time is simple with auto-population and easy categorization.

Scan receipts and invoices by snapping a photo. 1tap will extract data including supplier, date, amount and Schedule C tax category for you with UNBELIEVABLE accuracy. You can even see what purchases you can make with your tax savings!

💰Remember, the more receipts you claim back as a business expense, the less tax you pay, so snapping receipts boosts your income!

1TAP RECEIPTS FEATURES:

Receipt Scanner & Tracker App 🔍

- Scan receipts on the go

- Receipt scanner instantly finds and logs relevant data

- Scanner app with amazing reliability, even on crumpled business receipts!

- Scan one receipt or many at once

- Tracking expenses shouldn't take forever. Let 1tap receipts do the work!

Self Employment IRS Tax Calculator 📱

- Self employed? Contractor? Tax time doesn’t have to be painful. Just snap to start!

- Receipt scanner extracts key information for business expenses & IRS Schedule C categorization

- Schedule C categorization is easy & automatic!

- Tax management and calculation can be tricky. 1tap will take care of it!

Turn Expenses Into Cash 💰

- Tax returns are due now! See how much money you’ll get back from the IRS on your tax return instantly

- 1tap even suggests rewards you could buy with your refund

- Business expense organization and tax management are fast & simple with 1tap

Self Employed & Contract workers - from entertainers, construction, photographers, designers & more - 1tap is perfect for you!

Choose the 1tap Prime subscription that's right for you:

1tap Prime Lite

============

- 100 auto-scans per year

- 24/7 receipt processing

- Comprehensive CSV exports

- 20GB receipt storage

- 12-month subscription: $24.99

1tap Prime Pro

============

- Everything in 1tap Prime Lite

- Unlimited receipt scanning

- 50GB receipt storage

- 12-month subscription: $49.99

1tap Prime Max

============

- Everything in 1tap Prime Pro

- Real-time sharing with accountant

- Includes VAT

- 12-month subscription: $119.99

Self employed & contractors have serious responsibilities and shouldn’t have to spend hours mired in stressful accounting work. 1tap receipts offers a smart & easy alternative that makes tracking your IRS Schedule C, tax return and finances for tax time hassle-free.

HOW IT WORKS:

1. SNAP A PHOTO

Open 1tap receipts and snap your receipt or invoice.

2. EXTRACT EXPENSES

Data from your receipts and invoices is automatically extracted & placed in the correct Schedule C category for your IRS tax return.

3. SAVE AND SHARE RECEIPTS

Receipts and invoices are safely stored, so you can share them with your accountant, business partners, bookkeepers or whoever else may need to see them.

Check out the reviews or try it out right now with the worst receipt you can find and see how it goes!

Rate the App

Add Comment & Review

User Reviews

Based on 0 reviews

No reviews added yet.

Comments will not be approved to be posted if they are SPAM, abusive, off-topic, use profanity, contain a personal attack, or promote hate of any kind.

More »

Popular Apps

Viking Clan: RagnarokKano Games

Govee LiteGovee

Submarine Car Diving SimulatorSwim with dolphins & penguins

FastRay Fast VPN Proxy SecureFast VPN Proxy Vless & Vmess

Union VPN - Secure VPN ProxyPureBrowser

Build World AdventureExplore city in cube world

VPN Hotspot Shield Proxy 2023SwaharApps

World War Heroes — WW2 PvP FPSAzur Interactive Games Limited

Oxy Proxy ManagerOxylabs.io

Zoom - One Platform to Connectzoom.us

More »

Editor's Choice

Grim Soul: Dark Survival RPGBrickworks Games Ltd

Craft of Survival - Gladiators101XP LIMITED

Last Shelter: SurvivalLong Tech Network Limited

Dawn of Zombies: Survival GameRoyal Ark

Merge Survival : WastelandStickyHands Inc.

AoD Vikings: Valhalla GameRoboBot Studio

Viking Clan: RagnarokKano Games

Vikings: War of ClansPlarium LLC

Asphalt 9: LegendsGameloft SE

Modern Tanks: War Tank GamesXDEVS LTD